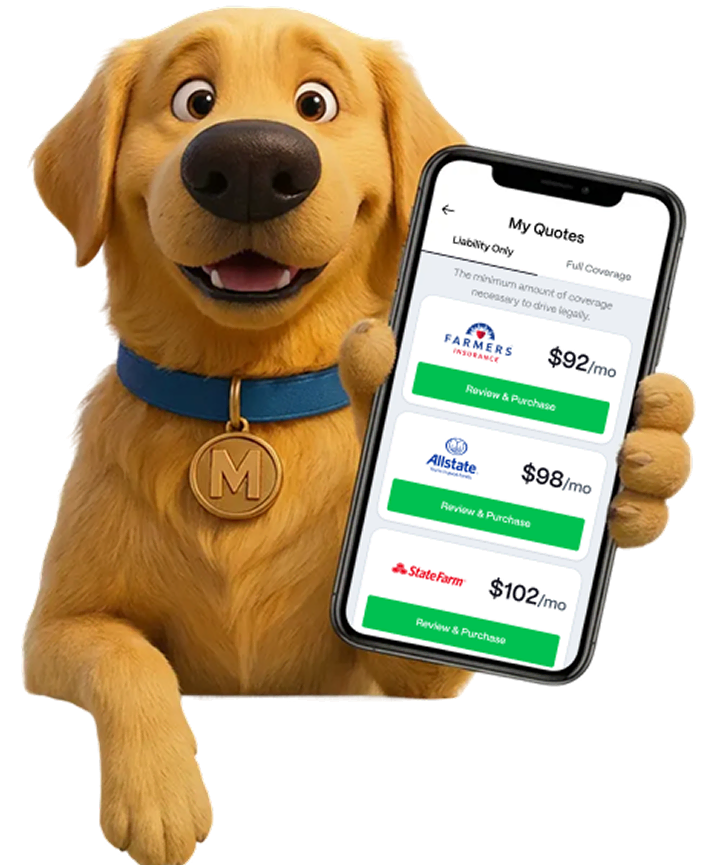

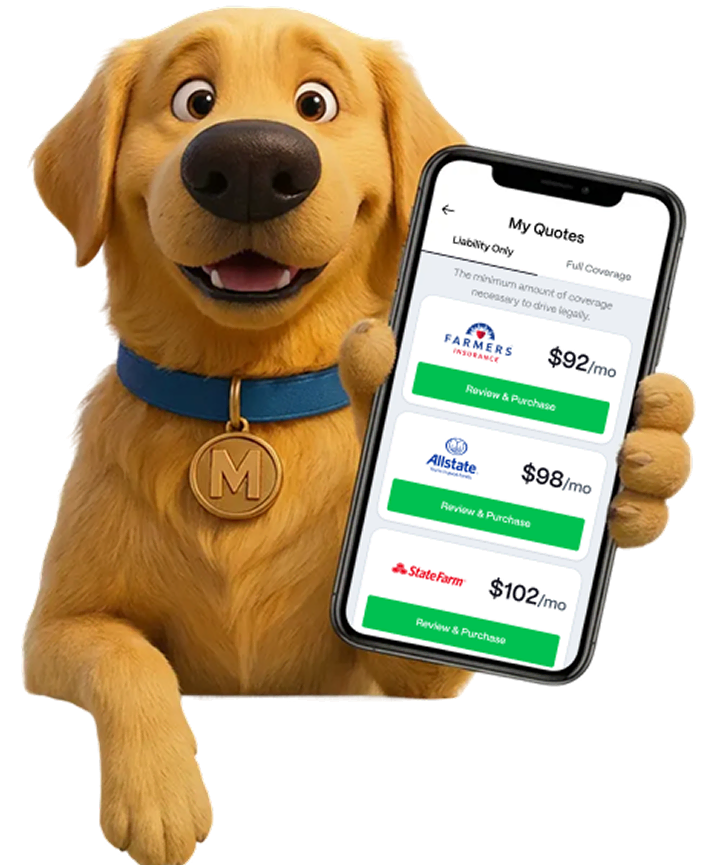

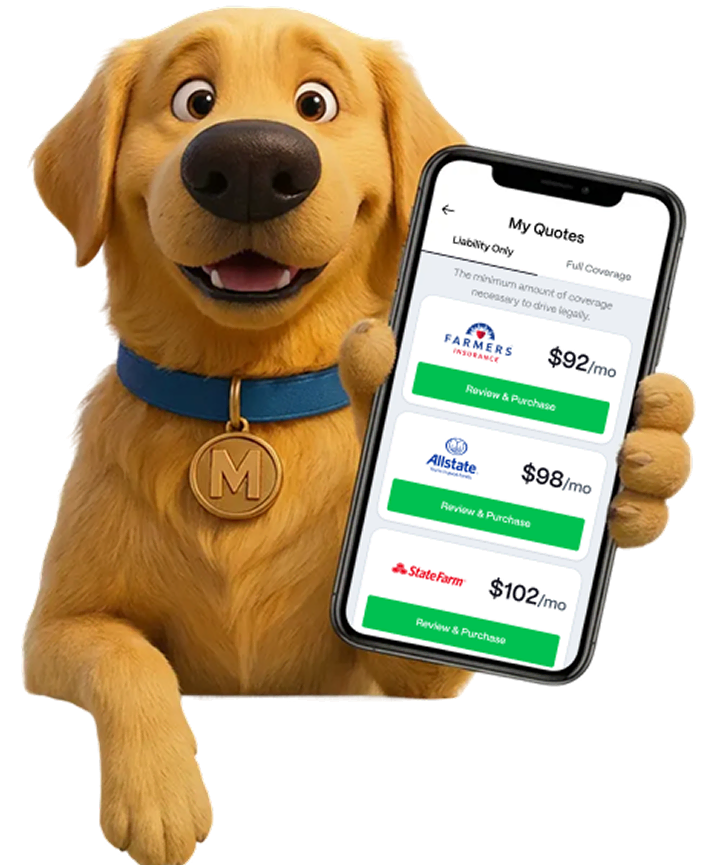

Find your best auto insurance with Max!

Excellent

Instant, side-by-side comparison

from top carriers.

Secured with SHA-256 Encryption

We work with 100+ companies

to find the best match for you!

123 reviews

123 reviews

Find your best auto

insurance with Max!

Instant, side-by-side comparison from top carriers.

Secured with SHA-256 Encryption

We work with 100+ companies to find the best match for you!

123 reviews

123 reviews

Find your best auto insurance with Max!

Instant, side-by-side comparison from top carriers.

Secured with SHA-256 Encryption

We work with 100+ companies to find the best match for you!

Save time. Save money.

Save MAX!

Get personalized quote in 5 minutes from top-rated providers.

Unbiased Rankings

Based on real customer experiences.

Trusted Providers

Top carriers. Real quotes. Clear choices.

Privacy First

No contact info required. No spam.

Glossary

Coverage that protects

what matters most

From liability to full protection, we help you choose the right plan to keep you covered on the road.

B

Bodily Injury

When other people are injured in a collision involving your vehicle—including passengers who are not related to you—their medical expenses are covered by the bodily injury liability portion of your auto insurance.

C

Collision

Damage resulting from a collision with another vehicle or a stationary object. For vehicles with an outstanding loan, replacement coverage is recommended to protect against financial loss.

C

Comprehensive

This component of the insurance policy covers repair or replacement costs if the car is stolen or damaged due to natural events. It also provides coverage for a rental car for the entire duration of your rental period.

F

Food Delivery Insurance

If you're a delivery driver, your personal auto insurance typically won't cover you while you're on the job.

G

Guaranteed Auto Protection

GAP insurance covers the difference between what you owe on your car loan and the car's actual value if it's totaled or stolen.

L

Liability

Every state requires that licensed vehicles carry at least the minimum amount of liability insurance. However, higher liability limits are often recommended to protect against potential lawsuits that may exceed the state-mandated minimums.

M

Med Pay

This coverage pays for medical expenses incurred by you and your immediate family in the event of an automobile accident. If you already have health insurance, this coverage may be redundant.

N

Non-Owner Insurance

Non-owner auto insurance is a type of liability coverage that protects a business from legal claims when employees use personal vehicles for company-related activities.

P

Parts & Equipment

Customized Parts and Equipment Coverage protects aftermarket or modified parts that were not installed by the original manufacturer.

P

Property

Liability coverage includes damage to public or private property belonging to others. However, it does not cover your own personal property.

R

Rideshare Insurance

Damage resulting from a collision with another vehicle or a stationary object. For vehicles with an outstanding loan, replacement coverage is recommended to protect against financial loss.

R

Roadside Assistance

Damage resulting from a collision with another vehicle or a stationary object. For vehicles with an outstanding loan, replacement coverage is recommended to protect against financial loss.

U

Umbrella Insurnce

Damage resulting from a collision with another vehicle or a stationary object. For vehicles with an outstanding loan, replacement coverage is recommended to protect against financial loss.

U

Uninsured / Underinsured

Damage resulting from a collision with another vehicle or a stationary object. For vehicles with an outstanding loan, replacement coverage is recommended to protect against financial loss.

U

Usage-Based Insurance

Damage resulting from a collision with another vehicle or a stationary object. For vehicles with an outstanding loan, replacement coverage is recommended to protect against financial loss.

Excellent

Compare top insurance rates in seconds

123 reviews

123 reviews

Compare top insurance

rates in seconds

Car Factors

How car type affects

insurance costs

Insurers price each car based on

risk, claims data, and driver behavior.

Sedan

Four-door sedans often have lower insurance rates, making them a top choice for executives. Insurers know these cars attract more responsible drivers, leading to fewer claims.

Sports Car

Sports cars often cost more to insure due to higher theft rates, greater collision damage, and riskier driving behavior. Their high replacement cost also drives premiums up.

SUV

SUVs often benefit from high safety ratings, which can lower premiums. However, some models may cost more to insure due to higher risks of property damage and injury from their typical use.

Pickup Truck

Pickups are used for a wide range of tasks, increasing the risk of damage or injury. Insurers often ask how they'll be used, and some models have high theft rates that raise premiums.

Hybrid

Insurers are cautious about hybrids due to battery fire risks in crashes, but companies like Farmers and Travelers offer a 10% discount for hybrid drivers.

Sedan

Four-door sedans often have lower insurance rates, making them a top choice for executives. Insurers know these cars attract more responsible drivers, leading to fewer claims.

Sports Car

Sports cars often cost more to insure due to higher theft rates, greater collision damage, and riskier driving behavior. Their high replacement cost also drives premiums up.

SUV

SUVs often benefit from high safety ratings, which can lower premiums. However, some models may cost more to insure due to higher risks of property damage and injury from their typical use.

Pickup Truck

Pickups are used for a wide range of tasks, increasing the risk of damage or injury. Insurers often ask how they'll be used, and some models have high theft rates that raise premiums.

Hybrid

Insurers are cautious about hybrids due to battery fire risks in crashes, but companies like Farmers and Travelers offer a 10% discount for hybrid drivers.

Additional Vehicle Insurance

Considerations

Purchase Price

Safety Features

Anti-Theft Devices

Insurance Institute

Real Customer Voices

Our customers say it best

1 week ago

Wish I'd done it sooner

Look, I've had the same insurer for probably 15 years. My daughter finally talked me into trying this. Took maybe 10 minutes and I'm saving about $40 a month. Wish I'd done it sooner.

Mark J

3 days ago

Actually way easier than I expected

Not gonna lie, I put this off forever because I assumed it'd be a pain. But it actually showed me like 6 different options and I switched to one that's $300/yr cheaper than Progressive. Pretty solid.

Jessica A

1 month ago

In and out, got what I needed

I insure two work trucks plus my personal vehicle. Usually comparing quotes is a whole project. This was in and out, got what I needed!

Daniel C

2 months ago

It walked me through everything

My son set me up on this. I was nervous about doing insurance stuff online but it walked me through everything. Ended up with a better rate than I had with Allstate.

Linda G

August 2025

That's groceries for a week

Paying for car insurance on a stipend is rough. Found something like $50/mo cheaper than what I was paying through my parents' agent. That's groceries for a week lol

Chris H

September 2025

Nobody called me 47 times

I requested quotes on a Sunday night. Got results immediately, picked a policy, done. Nobody called me 47 times trying to upsell me. That alone is worth it.

Angela M

October 2025

I ran the numbers myself

I ran the numbers myself afterward to check. The quotes were accurate, the coverage matched what was advertised. I went with Liberty Mutual through here — ended up being about 12% less than my previous policy.

Robert R

November 2025

Way less stressful

I don't have a regular paycheck so every expense matters. Being able to actually compare things side by side instead of calling five different companies? Way less stressful.

Emily J

December 2025

Didn't have to talk to anyone

I hate dealing with insurance people. This let me handle it myself online without talking to anyone. Got a better rate too. Can't complain.

Jason M

January 2026

Two coworkers switched too

I told the teachers in my department about this after I used it. Two of them switched insurers too. It's nice when something actually does what it says it will.

Patricia S

We're rated Excellent

123 reviews

Excellent

Get fast, free auto

insurance quotes

123 reviews

123 reviews

Get fast, free auto

insurance quotes

How to choose an auto

insurance company

Selecting the right insurer means looking beyond price. U.S. insurance companies are strictly regulated and must report their financial strength quarterly—giving consumers transparency and confidence.

A key tool for evaluating an insurer's stability is the A.M. Best Company Rating, used since 1905 to assess financial strength (A+, A, A–, B+, etc.).

- Top ratings ("Most Substantial," "Most Favorable") indicate strong financial footing.

- Qualifiers like "very" suggest solid but slightly lower stability.

- No descriptors often signal weaker performance.

Check ratings at ambest.com to ensure your insurer is dependable today and prepared for tomorrow's claims.

|

Company Name |

A.M. Best Rating |

Premiums Written |

Market Share |

|---|---|---|---|

|

A+ | $36.58B | 10.2% |

|

A | $6.17B | 1.7% |

|

A+ | $60.05B | 16.7% |

|

A++ | $41.71B | 11.6% |

|

A | $13.49B | 3.8% |

|

A | $11.74B | 3.3% |

|

A++ | $7.1B | 2.0% |

|

A | $4.80B | 1.34% |

|

A++ | $22.09B | 6.2% |

Frequently Asked Questions

Insurance Made Simple

What is SaveMaxAuto?

SaveMaxAuto is a virtual insurance representative that gives you real-time quotes from over 127 carriers, including names you might know like GEICO, Progressive, and Allstate. This lets everyday people compare policies and save hundreds of dollars per year by choosing a policy that fits their budget and coverage needs.

How does SaveMaxAuto Find Me Quotes?

At SaveMaxAuto, all you have to do is complete a simple form, and our AI comparison engine will get personal quotes from multiple insurance partners. You can also call our direct phone line anytime to speak with a friendly agent and get customized quotes for your vehicle and location. After you find the best rate for you, you can pick a quote and buy your policy online or over the phone with one of our licensed insurance representatives.

Is SaveMaxAuto really free to use?

Yes, our website SaveMaxAuto is completely free to use with no limits or restrictions. The price you pay is the same as if you went directly to your local insurance office. There are no hidden fees or charges from our website.

How does SaveMaxAuto make money?

Like many other insurance comparison platforms, SaveMaxAuto will make a commission if you get a policy through one of the carriers we showed you on our website. We may also get compensated if you click directly to one of the insurance carriers that is dsiplayed on our website. We don't make money selling your data. Instead, we provide the best resources possible for you to find coverage that works for your budget. Visitors to our website will never pay us directly. Instead we work with our quality partners to ensure you find the best insurance rates near you.

Is SaveMaxAuto a licensed insurance agency?

Every agent you speak with after filling out a form on SaveMaxAuto is a licensed agent. While we are not an insurance carrier directly, we partner with over 122 local insurance companies to find the one that is best for you. Our job is to provide unbiased information and the most accurate quotes possible so you can choose the company that best fits your needs. Learn More: How our business works.

Need more help? Call us anytime — it's FREE!

Excellent

Compare top insurance rates in seconds

123 reviews

123 reviews

Get fast, free auto

insurance quotes

Customer Satisfaction & Complaint Score breakdown

There's no universal customer service rating for insurers, but the complaint ratio offers a reliable indicator. Tracked by the NAIC, this score shows how often customers file complaints against an insurer, allowing you to compare a company's performance to the national average.

J.D. Power Auto Insurance Claims Satisfaction Ratings

Understanding liability

laws in your state

To help control rising auto insurance rates caused by increasing lawsuit awards, some states have adopted a modified no-fault insurance system. This approach reduces legal costs and speeds up claims by changing how liability is handled:

Excellent

Get fast, free auto insurance quotes

123 reviews

123 reviews

Get fast, free auto

insurance quotes